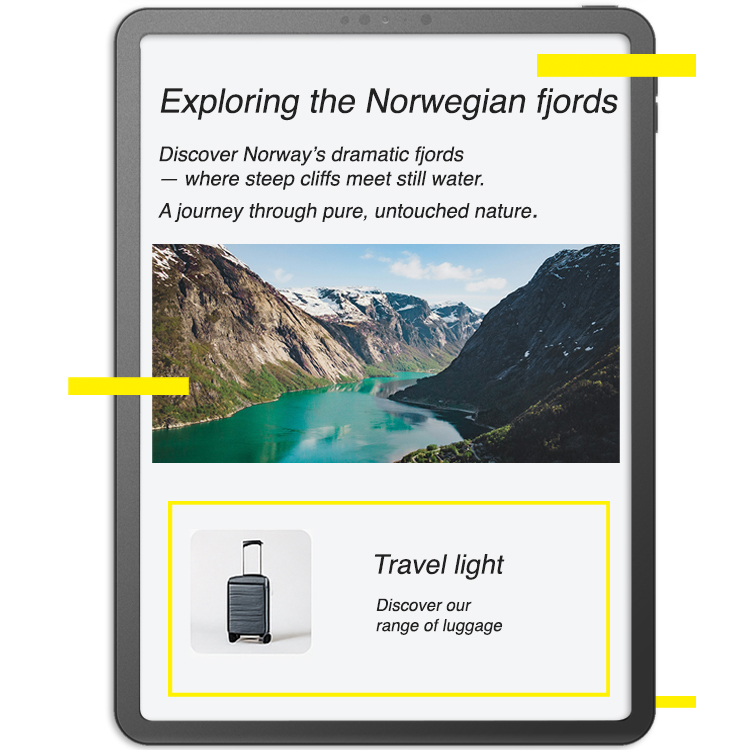

Contextual advertising. Privacy-safe and cookie-free

How it works

✔️ Scans 10,000 new articles every week – in real time

✔️ Matches your ads with highly relevant editorial content

✔️ Engages your audience at the right moment – no tracking required

Kobler connects your message to live, relevant content – based on the keywords, media sources, and topics you choose. You reach your audience while they’re actively reading articles directly related to your offering.

No personal data. Just perfect timing.

Hear it from our customers.

“We use Kobler for our strategic campaigns in our search for customer and candidate leads, and we’ve seen great results. Our experience with the Kobler team has been unequivocally positive—we feel seen, heard, and well cared for.”

“Contextual advertising makes our content appear at the very moment the media start writing about the topic. When a lot is being written on a topic, like a cyber attack, we’re at the ready with highly relevant content.”

“We‘ve become very fond of Kobler and we wholeheartedly recommend them to anyone looking for a superior advertising solution.”

“Høyre has used Kobler for contextual targeting on several occasions, which has secured a high degree of relevant ad views in the right places. Kobler has been very helpful with idea sparring and setting up ad campaigns.”

“Kobler is an important part of the targeting tools we use when planning a campaign. As an added benefit, we always receive great support from Zryan and the Kobler team.”

find the ad more relevant

Ads shown in the right context feel more relevant — up to 25% more, according to users.

And it has nothing to do with personal data.

Source: Survey by YouGov and Annonsørforeningen

react more positively to the brand

When the same ad is shown in the right context, 33% more people respond positively to the advertiser.

That’s a major win for brand impact – no targeting needed.

- • GDPR-compliant and privacy-first – no cookies or tracking.

- • Full transparency from start to finish: placements, cost and context.

- • Easy to use – no media buying experience required.

- • Built-in sensitivity filter for brand safety – can be turned off if needed.

- • Tracks and stores personal data – sometimes shared or sold.

- • No transparency – you don’t know where your ad appears.

- • Brand risk – poor ad placement can harm your reputation.

- • Low relevance – ads often feel out of place and are ignored.

Context

wins

attention

Have questions or need a starting point? Talk to one of our experts – we’ll guide you through.

- Senior Advisor

- kjellove@kobler.no

- +47 930 30 369

- Sales Manager

- philip@kobler.dk

- +46 73 987 93 98